Market Insights Mean Increasing Opportunities for Comparison

It has never been easier for customers to compare prices and delivery times online - even for spare parts. Customers' purchasing decisions are based on current and real information from the market. Information against which it seems almost impossible to align and keep all prices up to date.

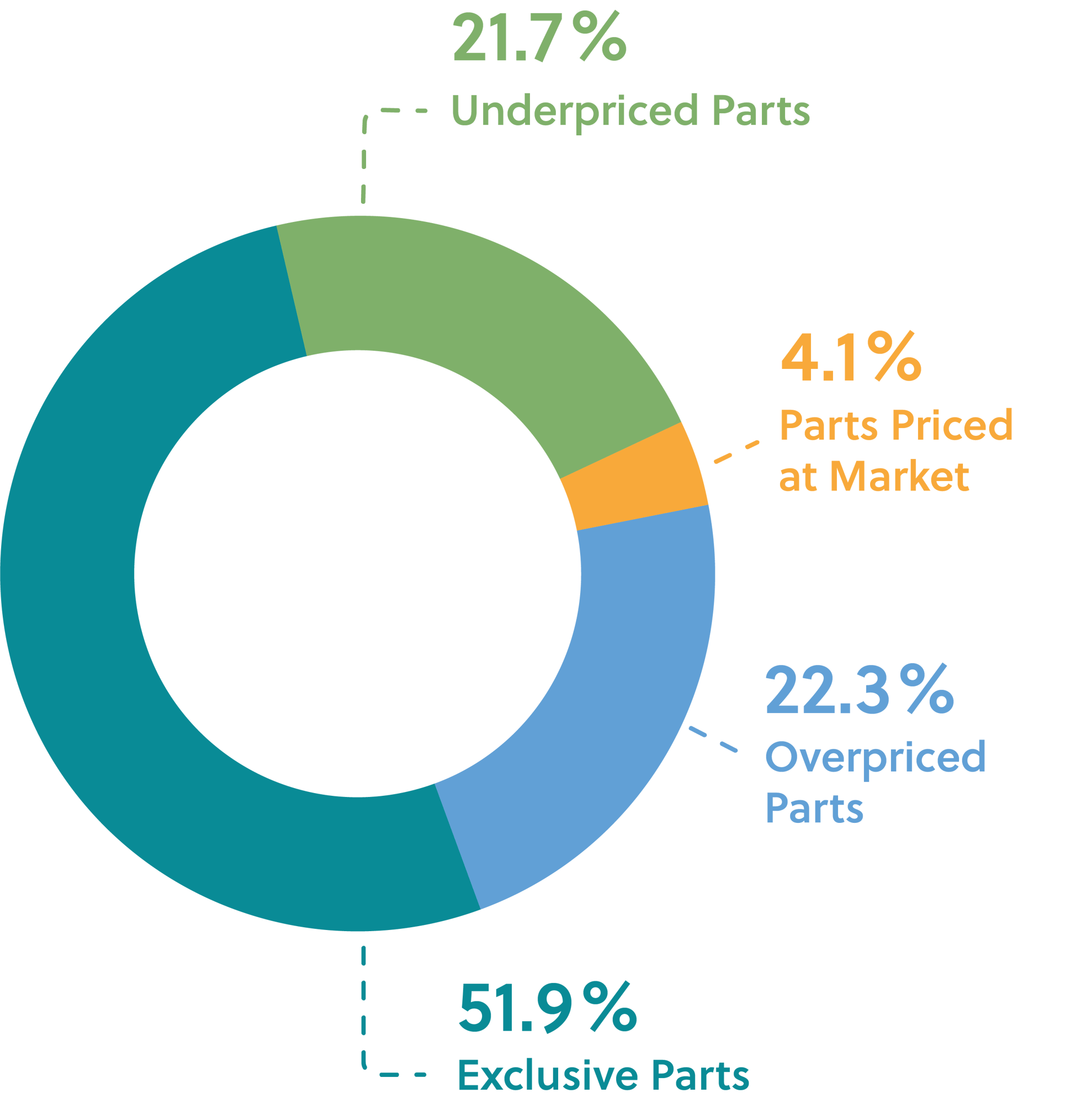

Automated market price research provides machine manufacturing companies with all information on prices and delivery times of their spare parts in one overview, enabling them to act accordingly and establish market-based pricing. With spare parts prices that are based on current and well-founded data and are fairly aligned with the market, companies gain the trust of (new) customers and counteract the price sensitivity of buyers.