Manufacturers leave money on the table for 73% of their purchased parts

The biggest challenge in spare parts pricing? Nailing the perfect selling price.

The solution? A market-based spare parts pricing strategy. Shockingly, only 4.1 % of all spare parts are priced in line with the market - use your potential and maximize sales, profit and customer satisfaction.

Maximize Your Spare Parts Profits

Pricing Software designed for Machine Manufacturing

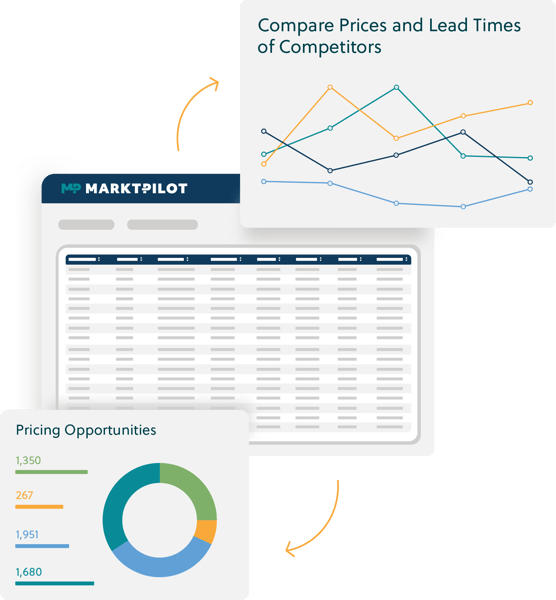

Access to lead times, prices, and price trends of all your competitors? No problem with MARKT-PILOT's pricing software..

Full market transparency and personalized value drivers enable AI-powered price recommendations for your spare parts business.

Face Economic Challenges With a Strong Spare Parts Business

Whether it's just 500 or several thousand parts: managing your pricing manually isn’t effective anymore. It's time-consuming, leads to 96% of parts being mispriced and results in missed revenue opportunities. With growing economic pressures, digital solutions are key.

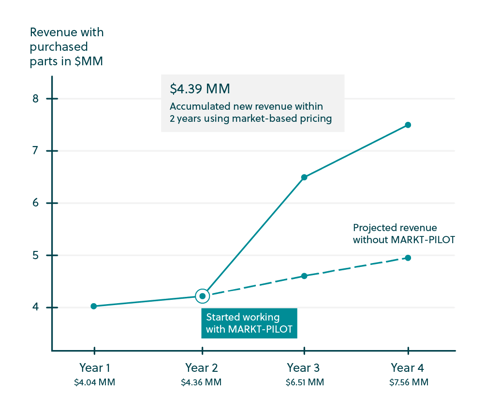

With MARKT-PILOT, you start tackling the challenge of pricing spare parts effectively. By implementing market-based pricing, you can increase 21% in spare parts sales on average and ensure pricing your customers accept.

Are you ready to unlock your full pricing potential?

Say Goodbye to Guesswork and Hello to Marked-Based Pricing

Higher Customer Satisfaction

Improve your customer loyalty and satisfaction in the long run. By adjusting prices to the market, you create transparency and strengthen customer trust.

Extensive Market Transparency

Work with expert-validated data built on over 24,500 online and offline sources, delivering unmatched pricing insights.

Expertise for More Revenue

Benefit from our industry expertise and increase your revenue with the only B2B pricing software designed specifically for the spare parts business in machine manufacturing.

Seamless Integration

Capitalize on market exclusivity for parts with limited competition.

PRICE INCREASE

Increase prices with confidence for underpriced parts.

MARKET SHARE

Increase win rate, improve price image, strengthen cross-selling.

PURCHASE

Negotiate thoughtfully and find new suppliers.

What our Customers say

"I would recommend MARKT-PILOT to every machine manufacturer because MARKT-PILOT supports you in a market-based approach and offers a different perspective, outside of your field of competence regarding parts pricing and lead times."

"I honestly did not expect the high added value that the software offers us and am more than convinced by the quality. I find it remarkable how quickly and reliably results are delivered and I can only praise the entire team at MARKT-PILOT."

Why MARKT-PILOT

Enterprise-Grade Security: Our ISO 27001 certificated software guarantees you top-tier data protection and full compliance with industry standards.

Seamless Integration: Fully cloud-based - simply log in to our website and you're all set for marked-based pricing without any complex IT setups required.

AI-Powered Pricing Logic: Define your own value drivers and automate your pricing rules. Use AI-driven pricing simulations for increased revenue and accuracy.

Tailored Options: Dive into competitive market data yourself or use our AI-driven recommendations tailored to align with your business goals. The choice is yours.

WHY MARKT-PILOT

Strengthening the Spare Business With Market Intelligence

By leveraging advanced technologies, you transform collected market data into personalized pricing recommendations. Use this knowledge to eliminate intransparent and slow pricing processes. Replace uncertainty with transparency.

With MP, you gain clarity in pricing in machine manufacturing and can make informed decisions with confidence. Market intelligence sets your spare parts business apart.

Subscribe to our Newsletter

Tips and news from the areas of spare parts pricing and digitalization in aftersales.

Amanda Smith

FOUNDER, CEO & EXECUTIVE CHAIRMAN

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.