Unlock Hidden Revenue in Just 2 Minutes

What if we can show you how to unlock hidden revenue in just 2 minutes with our ROI Calculator?

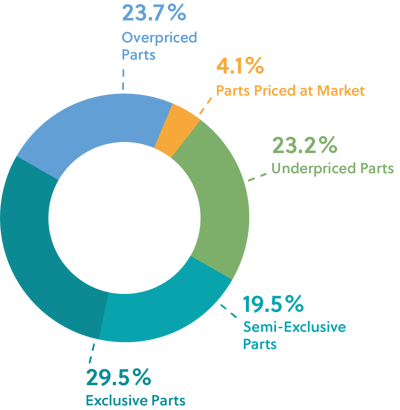

96% of spare parts are mispriced, either overpriced, pushing customers away, or underpriced, draining your margins. Find Out What You’re Leaving on the Table

Our calculator provides valuable insights into the impact of pricing on your revenue and lets you test three different ROI scenarios to optimize your strategy. In just minutes, you can see how much hidden revenue you're missing. Try it now!

Uncover Your Full Potential

Maximize Revenue and Stay Competitive

Machine manufacturers unknowingly lose up to 21% in spare parts revenue due to outdated pricing strategies. Without real-time market data, you're guessing instead of optimizing.

The ROI Calculator provides immediate insights into your pricing gaps, helping you unlock new revenue streams and strengthen your bottom line.

What You’ll Get:

- The impact of pricing on your revenue

- Three different ROI scenarios to test and optimize

Our AI-Driven Pricing Solution

MARKT-PILOT gives you complete visibility into the market, allowing you to:

✔ Identify competitor prices, lead times, and availability with a single upload

✔ Get AI-powered, expert-validated pricing recommendations

✔ Track and improve ROI month after month

See how much hidden revenue you’re missing in two minutes.

Ready to Start Winning

Discover what happens when you stop guessing and start optimizing.

Dive into your untapped revenue with MARKT-PILOT’s AI-driven platform.